Partnering with other Real Estate Investors is a great way to increase your chances of success when flipping a house. With so many diverse skills needed to be successful, its almost unreasonable to ask a single house flipper to master them all. By including two or more people in your flip partnership, you can divide the responsibilities and risks while multiplying your skills and network.

The best co-flipper partnerships include people with opposite strengths and weaknesses. Taking on a partner with different but complementary skills can help ease the workload, avoid knowledge gaps, and lead to a smoother project overall. Here are some tips and benefits on entering a house flip partnership agreement:

A SWOT Analysis is a component of most business plans which acts as a framework for a company’s place in the industry. Its an acronym for “Strengths, Weaknesses, Opportunities, and Threats.” When we posted our free business plan template, we mentioned that it is vital to know what you do best, what you are only good at, and what skill set you might lack. The four categories sometimes overlap. All are important but for the purposes of this article, weaknesses carries the most weight. Identifying these is the easiest way to determine whether you need a partner, and if so, whom to seek out. A SWOT analysis clearly identifies what you need to know and what skills you could benefit from by adding to the team. With this knowledge, you can choose a stronger candidate to complement your existing skill. As the old adage goes, when you know better, you do better.

Forming a house flip partnership is much like a merger or acquisition of two companies that we read about in the news. The fairly recent notables include Disney and Pixar, Exxon and Mobil, Marriott and Starwood. A recent article about the Marriott-Starwood merger sheds some light on just one reason that the two companies to merge – combined, they offered a better product. The article explains that the reward programs for guests would now combine, allowing members access to twice the room selection. Also one business offered the top-tier, luxury style hotel which the other lacked, filling in the spectrum of available product for guests. You can see that picking the right partner can fill in your weaknesses and make the whole venture stronger.

Lets say you are a realtor with a real talent for landscape design. While anything you touch turns into a botanical garden, you lack interior contracting skills and knowledge. If you decide partnering is a good idea, who do you think you should partner with? Obviously, you want a partner that makes up what you lack — in this case someone with an eye for interior layout and design, and maybe even a third partner with contracting experience.

Investor group meetings are a great place to meet other investors to team up with. However, you might also have good luck meeting someone with the skills you are looking for by attending trade specific meetings. If we apply the above scenario again, you could certainly attend real estate investing meetings, but also join some electrician’s clubs or interior design meetups. The name of the game is to save costs wherever you can. If you can find a like-minded electrician or interior designer to partner with, that’s money saved, profit made, and headache avoided.

In addition to rounding out the abilities on your team, there are many advantages to forming a partnership with another investor. One that isn’t immediately thought of is what we call the “half advantage.” Your role in the project is now, in theory, half as stressful, you have half the workload, and half the liability. Unfortunately, a partnership also means half of the profit, but smart investors reinvest that time in other projects. In doing so, they have now made their team stronger, more efficient, and produced more reputable work, all by bringing on someone who remedies the weakness portion of their SWOT analysis.

This may be the most significant reason to seek a partnership for some. Many potential house flippers call into the offices of RFG and present their personal credentials. Obviously we see a wide range of credit scores, incomes, and liquid assets, some of which fit within our parameters. For those that don’t, a partnership may be the only way to get a loan from a lender. Lenders can use the higher of the two credit scores, combine the cash of the two partners, and use both incomes in order to qualify the loan, strengthening the two by combining their finances. We have seen partnerships where one lacks in cash and the other lacks in credit, but together they balance out the file and make it possible to get a loan.

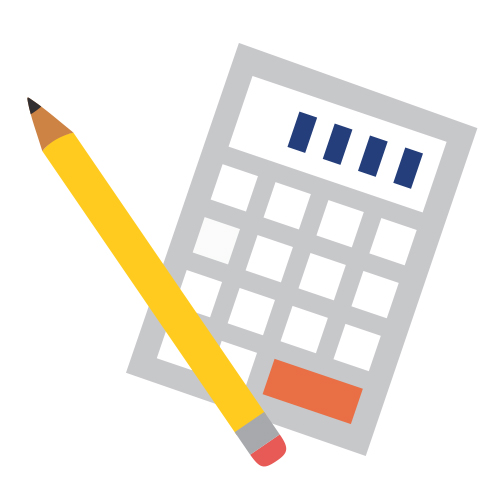

Doubling down on skills also means quicker turnaround times on projects as long as you prepare a solid Property Investment Plan. Now you can finish a project in five months, whereas before, as a single project manager, it took seven months. Below is a rough estimate of what two months’ carrying costs look like on a $180,000 loan:

Interest payment: $2,000 x 2 = $4,000

Taxes: $2,500 x 2 = $5,000

Insurance: $1,800 x 2 = $3,600

Utility Bills: $200 x 2 = $400

Miscellaneous: $250 x 2 = $500

Two additional months costs: = $13,500

Of course, this final figure is halved between you and your partner, so you have saved yourself $6,750 by knocking two months off your projects lifespan. If you were looking to somehow quantify half as stressful mentioned previously, that should do the trick.

Partnering with another investor is not an easy task. Its worth taking the time to make sure your personalities mesh as well as your skill sets before entering a partnership agreement. If you work well together, it may be the start of a mutually beneficial partnership.