Aloun Khountham is a freelance real estate contributor to The Close. Her real estate experience stems from over five years as a New York City real estate operations executive for a growing brokerage. See full bio

Reviewed by Table of ContentsReferrals are a great opportunity to give and receive leads among real estate professionals. They help agents work together and offer the best services to their clients. This guide will spell out everything that you need to know concerning real estate referral fees, including what they entail, how they work, typical referral fee amounts, and how to draft and manage referral agreements. Mastering these elements will be pivotal to successfully dealing with referrals and improving your business and client relationships.

A referral fee is the money paid to or received when a real estate agent has referred a client to another real estate agent. This simply creates an incentive for agents to share leads to ensure that the clients get the best possible service, even if the original agent cannot look after these clients directly.

A referral fee in real estate greases the wheels of real estate business by setting up an interactive network among agents and clientele. The associated fee benefits incentivize the agent to refer clients to other appropriate colleagues who can best meet their requirements so that the client is perfectly matched with the right area of expertise.

Real estate referrals include different parties with specific roles and responsibilities. The following are some of those roles that are involved in a referral transaction:

The standard referral real estate fee is around 25% of the gross commission earned by the receiving agent. This is also a similar rate for a referral fee for commercial real estate. However, this rate is extremely dependent upon the agreement between the agents and further details of a referral.

For example:

A buyer was referred to a buyer’s agent and the deal closed.

Calculate the referral fee:

The total amount of the referral fee paid out would be $3,750.

Variables that could impact the amount of the referral fee would include the sophistication of the referral, market conditions, and the level of required service. In these cases, it can range from as low as 20% to as high as 35%, depending on these factors. The referral fee should be negotiated and stated upfront when giving or receiving any referral leads.

The referral fee is paid to the referring agent from the commission of the receiving agent in a transaction. The client is not responsible for the referral fee. They are only responsible for paying the entire fee for the services, and the receiving agent will split their share according to the agreed rate. Normally, this payment is made after the completion of the transaction.

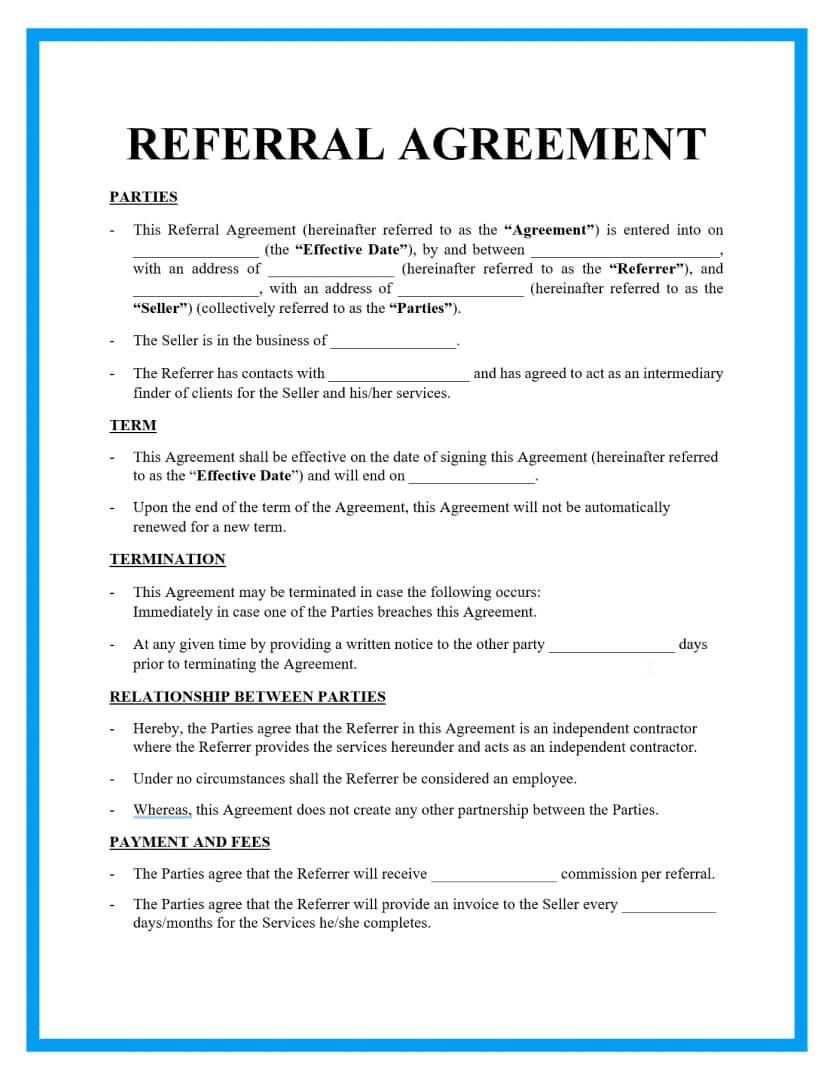

Before any referral leads are given or received, there are major factors to consider in a referral agreement. Such a document is required for a successful referral process and brings clarity and fairness to both parties. A good referral agreement should be able to capture the following key elements to avoid miscommunication and secure the interests of both the referring and receiving agents:

When referral opportunities arise, you don’t want to scramble and waste time getting documents together. Having a pre-made referral agreement allows you to simply fill in the details and proceed efficiently. This simple contract covers the required elements in a realtor-to-realtor referral fee agreement. I have put together a free, easy-to-use template that you can download and use today. Just click the button below to get started.

There are many reasons why you would refer a client to another agent. At the end of the day, you always want to look out for the best interests of your client. Referring clients to other agents ensures you are offering your clients the expertise and service that best fits their needs. The referral may also be due to work that is outside your scope or capacity.

Agents should consider referring clients to others in the following situations:

If you are the recipient of a referral deal, there are some important steps to complete to ensure the referral is finalized correctly. Most of the time, the referring agent will follow up with you to make sure the deal is going smoothly. However, if they do not, you still want to maintain a professional relationship by following the below steps and ensuring you get more referrals in the future.

Here’s what you need to do when a referral deal closes:

Confirm closure details: Confirm that everything regarding the deal has been closed out in accordance with the terms of the referral agreement. Every document needs to be signed and submitted.

Notify referring agent: The referring agent or broker should be notified regarding the successful closure. Any details regarding completion may be provided.

Calculate the referral fee: Calculate the referral fee amount based on the percentage of the commission paid as agreed upon. The amount must be calculated per the terms spelled out in the referral agreement.

Make the payment: Pay the referring agent or broker in a timely manner. Use the payment type set by the referral agreement, which might be a bank transfer or check.

Send documentation: Send a copy of the final closing statement, together with other documentation to be used, to the referring agent. Attach an itemization of how the referral fee was calculated.

Thank the referring agent: Don’t forget to thank them for the referral. This part is instrumental in maintaining a good relationship for future referrals. A gift could also be a nice gesture to maintain future lead flow.

The referral fee is the percent of commission paid to the referring estate agent by another agent when a client is referred. A commission will be paid to a representative for the completion of a transaction. In most cases, this commission is a percentage of the sale price of a property from the seller to the listing agent. The commission is to be divided accordingly between the listing agent and the buyer’s agent. If the buyer’s agent received the lead as a referral, they will take a small percentage of their commission and give that as a referral fee.

Though predominantly practiced by licensed real estate agents and brokers, referrals may also be conducted by unlicensed individuals and other real estate professionals. Professionals such as mortgage brokers or attorneys who deal with clients interested in real estate may refer leads to an agent. Former clients can always refer their friends or relatives to an agent, and many times they are given incentives or gifts in return instead of a referral fee.

The fees are usually based on the percentage of the commission that will be obtained by the completing agent. In most cases, a referral agreement will exist whereby the agents agree to share at a given percentage before doing the referral. The standard referral fee in the real estate business often runs at 25% of the full commission received but can change depending on the particular details of the transaction. All agents need to articulate the referral fee structure clearly in a written agreement so that confusion can be avoided and transparency maintained.

Proper understanding and management of real estate referral fees are key to greater cooperation between agents and giving the highest-quality service to clients. Referrals will expand an agent’s network and align clients with the appropriate expertise to ensure successful transactions and positive testimonials. By cultivating a robust referral system, agents can consistently generate new business opportunities. This approach benefits all parties involved, creating a thriving real estate ecosystem built on trust, cooperation, and mutual success.

Have you ever worked on a referral deal? If so, tell us about it below!